📌 Introduction: The Hidden Side of Passive Investing

In recent years, passive investing has become the default strategy for millions of investors around the world. It’s simple, low-cost, and historically reliable—especially when using popular index funds like the S&P 500 or Nasdaq 100.

The idea is straightforward: instead of trying to beat the market, just ride with it. But what if the market itself becomes risky?

As global dynamics shift, inflation persists, and certain sectors become overheated, the cracks in traditional portfolio management approaches are beginning to show. More investors are starting to question: Is passive investing as safe as we’ve been told?

This article dives deep into the market risks associated with passive strategies, explores how the concentration of capital in just a few mega-cap stocks could expose investors to hidden vulnerabilities, and examines how active investing may be regaining relevance in a rapidly evolving financial landscape.

Table of Contents

📈 Section 2: The Appeal of Passive Investing

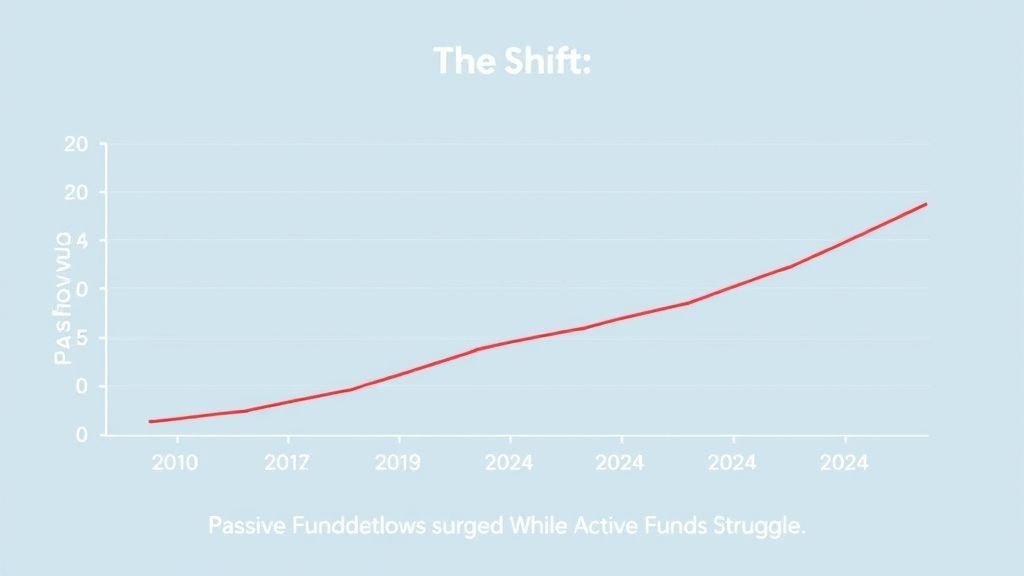

The rise of passive investing has been one of the most significant shifts in modern financial history. For decades, individual investors and institutions alike have increasingly embraced index funds as the go-to solution for building long-term wealth.

Why the popularity?

- Low Fees: Passive funds usually come with ultra-low expense ratios, making them cost-effective compared to most active investing strategies.

- Market Exposure: By investing in a broad index, you instantly diversify across hundreds of companies—spreading out market risk.

- Ease of Use: No need to monitor markets daily or make constant trading decisions. For many, it’s the ideal form of portfolio management.

These benefits, combined with long-term bull markets and the growth of ETFs, have led to trillions of dollars flowing into index funds over the past two decades.

But here’s the critical question: just because something has worked in the past, does it guarantee safety in the future?

⚠️ Section 3: Cracks in the Passive Narrative

While passive investing has worked well in bull markets, it’s not without blind spots—especially in today’s unpredictable environment. Below the surface, several structural risks are beginning to emerge.

📌 Market Concentration: Indexes Aren’t as Diversified as They Seem

Most people assume index funds offer broad diversification. But today, a handful of mega-cap tech stocks dominate the S&P 500. Just a few names—like Apple, Microsoft, and Nvidia—often account for over 25% of the index.

This level of concentration increases market risk, especially when these stocks become overvalued. Investors relying purely on passive strategies may unknowingly be placing a large bet on a small group of companies.

📌 Index Bubble Dynamics

Passive flows automatically allocate capital without evaluating a company’s fundamentals. The more a stock goes up, the more weight it gets in the index—and the more money flows into it.

This feedback loop can create index bubbles, where valuations detach from reality. When corrections happen, portfolio management strategies that blindly follow the index may suffer steep losses.

📌 No Built-in Risk Management

Unlike active investing, passive funds don’t rebalance in response to new risks. They don’t avoid bad sectors or reduce exposure to crashing stocks. In volatile markets, this lack of flexibility can be costly.

Even Warren Buffett once noted: “Only when the tide goes out do you discover who’s been swimming naked.” Passive investors may find themselves exposed when that tide shifts.

🔄 Section 4: The Rise of Active Strategies Again

After a decade of dominance by passive investing, the tides may be turning. With heightened market risk, inflation uncertainty, and geopolitical shifts, more investors are reconsidering active investing strategies.

📌 Why Active Investing Is Gaining Attention

- Tactical Flexibility

Active managers can react to real-time data, avoid overvalued sectors, and rebalance portfolios to mitigate risk—something index funds can’t do. - Risk Management Focus

While passive strategies hold everything in the index—good or bad—active investing focuses on minimizing downside through sector rotation, cash allocation, or even defensive assets. - Opportunities in Volatility

Volatile markets often create mispriced assets. Skilled managers can spot and capitalize on these inefficiencies—something traditional portfolio management using passive models might overlook.

📌 Active ETFs: The Middle Ground

The rise of active ETFs blends the structure of index funds with the benefits of active investing. These products offer transparency and liquidity while giving managers room to maneuver in complex environments.

Investors are slowly rediscovering that sometimes, doing something beats doing nothing—especially when risk is no longer abstract.

🧠 Section 5: The Psychological Trap of Passive Strategies

The biggest risk in passive investing may not be structural—it might be psychological.

📌 Set-and-Forget Creates Complacency

Index funds are designed for simplicity, but that very ease can breed investor overconfidence. The illusion of safety often leads to ignoring real market risk. When markets rise, it reinforces the belief that doing nothing is always the right choice.

But markets don’t always go up. And when they fall, passive investors—lacking any built-in risk controls—often panic-sell at the worst possible time.

📌 Herd Mentality and Confirmation Bias

The dominance of index funds in recent years has led to a form of groupthink. Everyone’s doing it, so it must be right. But relying on historical returns to justify future performance is classic confirmation bias.

This behavior traps investors in a cycle of passive dependence, where the default strategy becomes the only strategy. This can be especially dangerous during major shifts in economic regimes or policy.

📌 Emotional Missteps in Portfolio Management

Even in passive investing, investor behavior plays a massive role in returns. The moment fear kicks in—whether due to media headlines, volatility, or job insecurity—rational portfolio management decisions often go out the window.

In uncertain markets, discipline is everything. But blind faith in autopilot investing may not offer the cushion people expect.

⚖️ Section 6: A More Balanced Approach for the Future

Rather than treating passive investing or active investing as a one-size-fits-all solution, the smarter path may lie in strategic balance.

📌 Diversification Beyond Just Asset Classes

True diversification isn’t just about holding stocks and bonds. It’s also about strategy diversification. That could mean blending low-cost index funds for core exposure with selectively managed active strategies that adapt to evolving market risk.

This hybrid model supports both long-term growth and short-term adaptability—a powerful combo in today’s uncertain landscape.

📌 Portfolio Management in the New Era

Modern portfolio management isn’t about timing the market or going all-in on a trend. It’s about risk-aware positioning. That includes understanding when passive investing works—and when it doesn’t.

Investors should ask:

- What’s my exposure to concentration risk?

- Am I comfortable with the current macro environment?

- Do I need more flexibility in volatile cycles?

📌 Passive ≠ Ignorance. Active ≠ Speculation.

The debate isn’t about picking sides. It’s about being intentional. Passive investing offers simplicity. Active investing offers control. In a world of increasing complexity, relying solely on one could be the biggest risk of all.

In short: Passive can be powerful. But active thinking still matters.

🧾 Conclusion: Rethinking the “Set It and Forget It” Era

For years, passive investing and index funds have delivered reliable returns with minimal effort. But as markets shift and risk becomes harder to ignore, that autopilot approach may no longer be enough.

This isn’t a call to abandon passive strategies—but rather, to reframe them. Blind allegiance to any single method, whether active or passive, is itself a form of risk. A new era of portfolio management demands flexibility, thoughtfulness, and yes—sometimes action.

In a world flooded with passive investors, maybe the true edge lies in staying awake at the wheel.

So as the next decade unfolds, the question investors must ask isn’t “Which strategy is best?”—but rather:

“What strategy fits this moment—and am I paying enough attention to know when that changes?”

💬 Which feature excites you the most? Comment below!

💡 Stay ahead of the future! Follow us on:

Facebook | LinkedIn